Recession, bear market, pullback, inflation, volatility… These are all headline-grabbing words being used to describe economic conditions today in the media. As always, we need to take the media with a grain of salt. In the news business, fear and worry sell news in both the print and digital world. Once we get below these headlines, we can plainly see that the world is not ending, and this too shall pass.

Looking at current economic conditions, we can see employment is still strong. Unemployment continues to run at a 50-year low and there are 5.45 million more jobs open than unemployed workers. Such strong employment can help buffer the U.S. economy from falling into a recession. Even when the employment tide starts to turn, that would stabilize wage growth and potentially reduce inflation and increase corporate earnings over the coming quarters.

Inflation is running hot at an annualized 8.5%. This over-inflation stems from numerous dynamic factors, including the fiscal stimulus provided to many Americans during the pandemic. This prompted outsized spending on goods through the end of 2021, and a subsequent shift to service spending such as travel more recently. Pundits suggest this spending shift is the result of pent-up demand, especially for travel, both for business and leisure. This persistent spending can also help to keep the economy from sliding too much, because once travel is booked, more than likely the trip will be taken, and more money will be spent on dining and shopping.

The only sector of the investment landscape that had a positive return for 2022 so far was commodities, up 18.4%. Commodities includes things such as oil, gasoline, copper, gold, nickel, iron ore, and agricultural items. We know all too well how much the price of gasoline went up in 2022! With the shutdown of mines and factories, there has been a tight supply of all commodities since the pandemic, and the war in Ukraine is not helping to ease supplies. This large jump in commodities should start to level out through the rest of 2022 and individual commodities will start to perform more based on their own supply/demand dynamic instead of the entire sector running hot from geopolitical issues.

The overall equity market as measured by the S&P 500 Index was down 19.96% for the first half of 2022, but it was very unevenly distributed. Growth stocks in the S&P 500 were down 27.6% while value stocks were down 11.4% for the first 6 months of the year. Dividend-paying stocks fared better than the overall market, as the cash dividend helps to offset some of the drop in price of the stock. This scenario is very typical of an end-of-market-cycle scenario where the economy is slowing, but it does not automatically mean we are headed for a recession.

While the S&P 500 Index is a broad measure of large cap stocks, the Russell 2000 is a broad measure of small cap stocks. Small cap stocks did worse than large cap stocks because the companies have uneven earnings, niche markets, and can have less-than-stellar balance sheets. Small cap stocks are down 23% this year, which has led to a valuation gap between large cap and small cap stocks.

Foreign stocks have followed the US markets in lockstep. The MSCI EAFE Index is down 19.2% so far in 2022. This is a broad measure of large cap stocks around the developed world. Just like the US market, when we drill a little deeper into the headline number, we find large discrepancies in overall performance. Part of the reason for the different returns from one country to another are the actions taken by their central banks and how reliant the economy is on commodities. The UK has been one of the most aggressive nations to increase interest rates, with 4 increases since the end of 2021. Meanwhile, the Bank of Japan has maintained ultra-low interest rates. For 2022, the MSCI UK index is down 8.8% while the MSCI Japan index is down 20%. The low interest rate stance has caused the Japanese currency to hit a 24-year low against the US dollar. This large imbalance is having ripple effects through their economy, especially as a large importer of oil and natural resources.

The bond market has been the real thorn in everyone’s side. Often when stocks fall, most investors rush toward the safety of bonds, but that has not been the case so far in 2022. For only the 3rd time in 60 years, stocks and bonds moved in tandem downwards, and more severely than ever before. This is caused by the unwinding of the excessive bond purchases made by the Federal Reserve during the pandemic and the removal of an ultra-easy interest rate policy. Even though many investors are surprised, it should have been expected. When interest rates go up, bond values go down, regardless of what the stock market does. We believe we are starting to see a reversal of this tandem movement. Yields on government Treasury bonds have risen high enough to offer a yield that investors are willing to accept and which are close to the dividend yield on stocks. We believe the worst is behind the most secure parts of the bond market for this year.

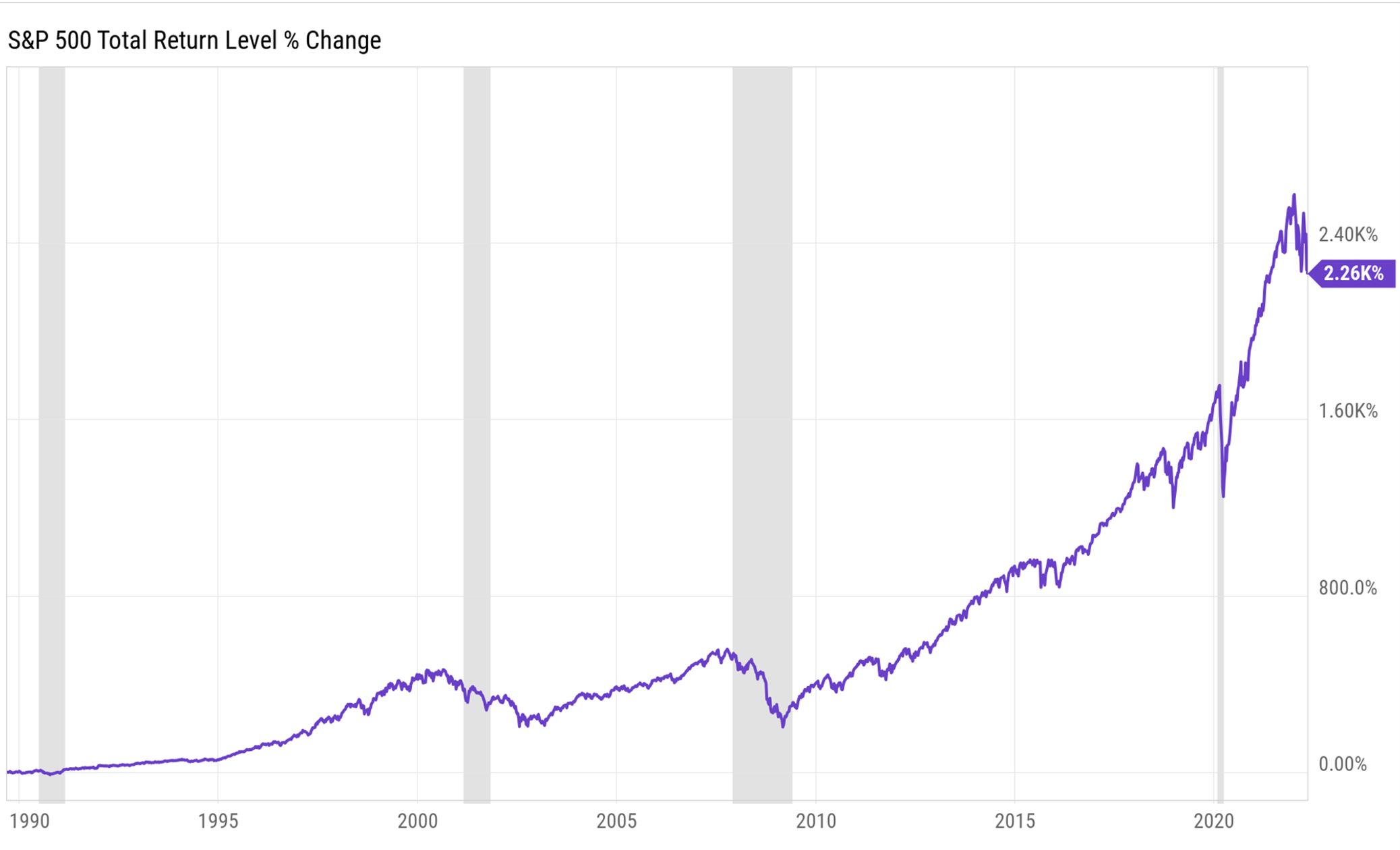

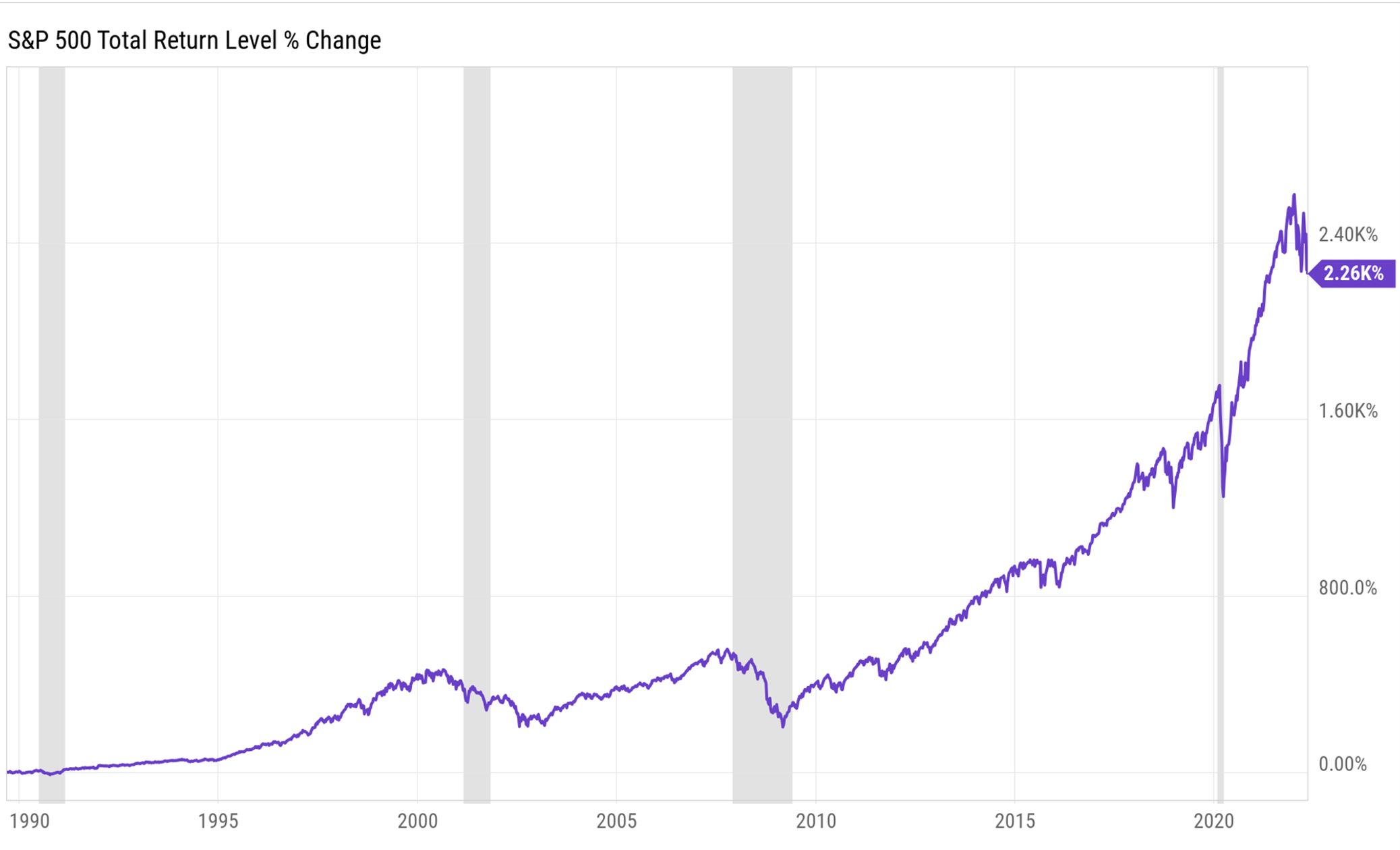

As you can see, even though markets have been turbulent and most broad indices have suffered in 2022, there are signs of optimism. It’s also worth noting, the average annual compound rate of total return of the S&P 500 from January 1973 until May 2022—after the Index suffered 3 major pullbacks of 50%—was 10.5%. This is almost exactly what its long-term (1926–2021) average has been.

If you would like to discuss markets, your current investment allocation, or how current market conditions are affecting your portfolio, please feel free to contact me at ted.schumann@dbsia.net or 800-327-2377.

So far, stocks have been struggling in 2022; they fell especially hard in April and the trend appears to be continuing into May. While it’s human nature to be initially unsettled by market turbulence, this recent market volatility is not a reason to panic or sell all your positions. If you are a day trader, you would have good reason to panic, but we are long-term investors, not traders.

Investors must remember that markets tend to be irrational in the short term, and certainly don’t need reasons for behaving (or misbehaving) the way they do. However, recent market conditions can be at least somewhat attributed to the following:

- Interest rates are moving higher, which can be bad for stocks and especially bad for high growth stocks.

- Increasing interest rates prompt growth stock investors (tech stocks tend to be growth stocks) to revaluate what they are willing to pay for the stocks based on discounted earnings. The higher rates go, the less valuable tech stocks look.

- Inflation is causing the prices of everything to increase. This also hurts corporate earnings. When it costs more for companies to make their products, they either charge more for their product or have less profit. Usually, it is a combination of both.

- However, not all parts of the market abhor inflation. It should be noted that commodities are doing especially well in the current market and inflationary environment.

- COVID-19 is still present around the world. Even though life here in the U.S. resembles pre-pandemic “normal”, the rest of the world isn’t there yet. For example, China has lockdowns in place that are causing factories to close and products to be delayed. This will have an effect on our store shelves for many months to come; most likely extending supply chain pains and contributing to transitory inflation.

Volatility is expected to be with us through the summer and possibly much longer. We had experienced a prolonged, calm, upward movement in the stock market for the past two years (as shown in the graph), brought on by the measures to combat the COVID-19 pandemic. The Federal Reserve just raised interest rates for the second time this year—as they had previously indicated they would do—and we expect they will continue to raise rates throughout the rest of the year. In response to the Fed raising rates, the stock market in turn fell more than 5% the day of this writing (5/5/2022). This can be great news for those of us with cash in the bank wanting to earn interest and for investors to lock in a higher bond yield than we have seen in the past 3 years.

Investors still in the accumulation phase—those working and making regular deposits (known as dollar-cost-averaging)—should not be disturbed by current market conditions. They are in a great position to take advantage of temporary market weakness and buy investments during market lows. As Warren Buffett once said, “The best chance to deploy capital is when things are going down.”

Investors in the distribution phase, like retirees, should be taking withdrawals from the cash positions of their portfolio so as not to sell during times of market turbulence.

This is a perfect time to remember to invest for the long-term and rebalance your portfolio on regular intervals. It is not a time to sell your portfolio and go into cash. Instead, it is a good time to add to strategies that do well with inflation and rising interest rates, such as commodities, small cap stocks, and consumer staples. If you would like to discuss your current investment allocation or how current market conditions are affecting your portfolio, please feel free to contact me at ted.schumann@dbsia.net or 800-327-2377.

By Ted Schumann II

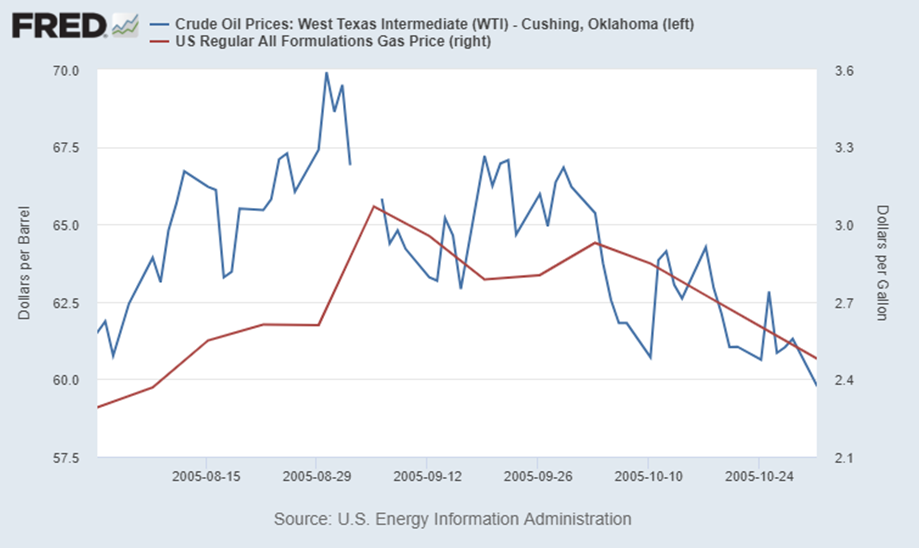

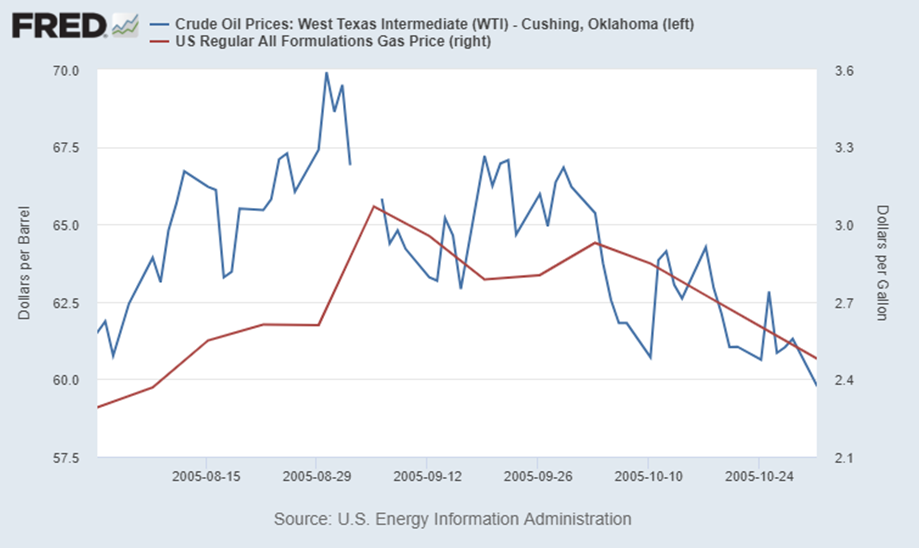

With Hurricane Ida sweeping through the Gulf of Mexico and Louisiana, 95.65% of the Gulf Coast’s crude-oil production, or 1.741 million barrels a day, was shut down, as well as 93.75% of the region’s natural-gas production according to the Bureau of Safety and Environmental Enforcement. One would think this would cause a jump in oil prices and natural gas prices as supply will be limited for the next few days, but instead the price of West Texas Intermediate crude oil was relatively flat with the price moving up $0.58 which equates to a less than 1% movement on Monday. Most of the movement in oil happened on Friday when it jumped 2% on the anticipation of the storm.

Oil producers and refiners saw a different Monday. Most of them were down more than 1% during trading on Monday with harder hit Phillips 66 down 1.4% after a temporary levee near one of their refineries was broken by floodwaters. The SPDR Select Energy ETF, XLE, was down 1.18% for the day. What does all of this mean to investors? It shows the expectation that the overall supply of oil will not be hampered even though some companies may suffer damage.

With refineries shut down, gasoline prices are expected to rise even if the price of oil does not rise dramatically. This happened after Hurricane Katrina as shown below. Oil prices were increasing leading up to Katrina but then fell dramatically. Gasoline prices followed oil, but with a lag. Gas prices peaked a week after oil prices peaked. So, drivers should brace for higher prices at the pump.

This could be a great time to look at your overall allocation to energy stocks and potentially scoop up some well-run companies at a discount. XLE is up 34% year-to-date through Monday, but was up as much as 56% at the end of June. Hurricane Ida should help reverse the pullback in oil prices caused by an increase in oil production from OPEC and a fear the COVID-19 uptick will reduce the economic comeback and demand for oil. XLE, along with most of the major oil producers, sport yields in excess of 4%, which is hard to find in today’s world of ultra-low interest rates.

If you have any questions about the current market environment and how it affects your portfolio, please feel free to contact me at ted.schumann@dbsia.net or 800-327-2377.

By Donna Rosebush, Practice Management Consultant

While the power of positive reinforcement and the notion that “you get what you reward” may seem to be common sense, it is not necessarily common practice in all organizations that I have observed. A lot of employers and employees think that they already do a great job of showing and communicating appreciation. Yet, here are some current and striking statistics based on an article from the Bent Ericksen HR newsletter:

- Only 29% of employees are engaged with their work

- 54% of employees are not engaged with their work

- 17% of employees are actively disengaged, meaning they’re regularly sabotaging productive work

- 79% of employees who quit their jobs cite lack of appreciation as one of the main reasons for their choice to leave

Bottom line: you may not be doing as good a job as you think. Your practice’s staff turnover statistic is often a good measuring stick for self-evaluation.

When it comes to management styles, people have a tendency to mimic the style they learned from previous jobs, employers, or personal relationships. After all, leadership skills are not something that we were born with, they are skills that must be learned and practiced. We tend to do what is familiar to us. And if your past experiences haven’t proactively embraced appreciation in the workplace, then odds are you wouldn’t naturally do it either. The good news is you’re not stuck with that model – you can learn a different style. There are libraries full of books on leadership/management styles, there are leadership coaches, and there is data on the most effective management styles.

At the core of any energized workforce is the quality of the one-on-one relationships that your individual workers have with you, their employer, and the trust, respect, and consideration that you show toward them on a daily basis. So often when I interview staff members one on one, I repeatedly hear “I never know if I’m doing a good job or if I’m about to be fired. I would really appreciate some form of review from the Dr.” When asked what would motivate them most, bring them the greatest satisfaction in their job, or what it would be if they could wave a magic wand and have any one thing change, the answer I hear 8 out of 10 times is “Better communication! More than a raise, I would love to know where I stand, get feedback on my performance, or be shown some form of appreciation for what I do. A simple yet sincere thank-you once in a while would go a long way!”

Think about a particularly tough day you’ve had recently—maybe the air compressor broke down one time too many, or a patient decided to vent his or her anger at you. Just when it seemed that all was lost, another patient, or colleague dropped by to thank you for doing a terrific job on a case that you are particularly proud of. Suddenly, your troubles with the air compressor and the angry patient were forgotten—replaced with the personal satisfaction of being recognized for a job well done. Employees are no different. People today are looking for much more than a paycheck. They want to be treated like professionals whose contributions are recognized and appreciated. That may sound obvious, and yet a lot of employers still don’t understand the direct correlation of job satisfaction vs. costly staff turnover.

While some claim that appreciation (or the need for it) is a generational trend—that “baby-boomers” work all day with no whining while those “millennials” can’t answer the phone without needing a compliment from their manager—the reality is everyone wants to be appreciated.

It doesn’t necessarily take much to bring out the best in people: simply asking for their opinions, providing an individual or the entire team with timely information that is important to them or involving them in decisions—especially when those decisions directly affect them or their jobs—can be very effective.

Empowerment—giving employees the responsibility and the authority to get things done their way can unleash tremendous amounts of worker energy. Employees want to feel that they are trusted and valued members of the team. When they are granted independence and autonomy, not only can you, the doctor, concentrate on production and other issues, but the employees are able to make better decisions—and they’re usually a lot happier on the job.

The key to the success of empowerment, however, is strong leadership. There is a fine line between success and abdicating the leadership role by handing off responsibilities without sufficient training, clear expectations, and/or review of the expected results. A great leader will take the time to identify the long term vision, communicate that vision to the team, encourage and empower the team/individual to take responsibility for their part in achieving the vision, and most importantly follow-up to ensure that each employee is held accountable and/or appreciated for their role.

Energized employees are creative employees. When they are engaged in the operations of your practice, employees will voluntarily seek out new ways to address and solve problems. The best organizations find ways to give their employees the time, support, and tools they need to stimulate creative thinking. Unfortunately, the hurried pace in most dental practices leave precious little time for employees to just think and create, which is why I always advocate dedicating time to productive staff meetings, administrative time, and off-site staff retreats. When working in such fast paced environments, it’s especially important for employees to be given opportunities to relax—share a laugh with their co-workers or just get away from the office for a bit as a team.

Face it—if your employees are stuck doing the same tasks over and over again, just like you, they’re going to find themselves in a rut. However, new challenges can reenergize them and restore their enthusiasm. Remember how you felt when you first started in practice—the excitement and anticipation, and occasional nervousness about starting a new procedure? Well, you can help your employees retain or recapture that feeling by allowing them to take on interesting new challenges.

Encourage employees to take on, or assign them small projects, which require learning new tasks, working under time pressure, and dealing with new groups of people. Such assignments might include:

- Creating a task force to revamp an inefficient office system.

- Planning an off-site staff retreat, CE conference, or “fun day” for the staff.

- Research a new technology in the dental field, followed by a presentation and training session for the team.

- Supervising product, program, equipment, or systems purchases (new treatment options like sleep apnea, implant technology or whatever else you may be interested in incorporating into your treatment mix, new software, patient contact enhancement systems, marketing, social media, website development…)

- Going off-site to work a health fair or present the benefits of good oral health to a classroom

- Supervising or assisting in a study club

- Supervising the furnishing or redecorating of the office.

- Making speeches for organizations

- Attend their local association meetings

- Dealing with a business crisis

- Supervising cost cutting.

- Write a new policy protocol, to be compiled to make an office procedural manual

- Head up a “reactivation of lost patients” campaign

- Prepare and present a marketing strategy to grow the practice

- Bring in a practice management coach to spark new ideas and help guide you toward positive change while reenergizing the team

As you can see, the ideas are as vast as one’s imagination or the specific needs of your practice. Be creative! The point is by delegating these necessary, yet interesting tasks, you will be reducing your required time while helping individuals to grow, take ownership in the practice, and reignite a new path of interest in their career. It’s WIN-WIN.

If you are interested and yet aren’t sure how to fit these exciting ideas into what seem to be already busy days and “overworked” employee schedules, give me a call. Where there is a will there is a way! I am always happy to help!

SUGGESTION BOX

Empowering employees will increase job satisfaction. Following are suggestions for lighting the fire:

- Encourage employees to exercise initiative in their jobs and to take risks without fear of retribution.

- Delegate all tasks that are legally within the realm of the employee

- Encourage and utilize expanded functions

- Encourage team members to seek out cost saving initiatives when ordering supplies, researching equipment purchases, adding efficiencies that reduce staff hours and labor costs and reward them with a percentage of the savings

- Have the team members rotate in planning agendas and chairing staff meetings to improve quality, productivity, training and patient relations

- Ask your employees to make lists of opportunities for career development, such as taking on new assignments, developing new skills, and participating in cross-functional teams. Then, meet with them to determine how these opportunities can be arranged and follow-up with on their progress during their performance reviews.

Create individual career development plans for each employee, detailing the skills they would like to learn and opportunities available for them, i.e. encourage assistant registration, hygiene-local anesthesia certification, front office-advanced training in computer software technology, etc. Make your expectations clear and reward their accomplishments.

Dear Friends,

I was a child of the late 50’s and early 60’s raised in a Catholic family. For those of you who were not raised in such a family, you may not have had the experience of riding in a family car under the protection of St. Christopher. In those days, automobiles had metal dashboards and no seat belts. It seemed almost every other vehicle had a four inch plastic statue of St. Christopher magnetically held to the dashboard. I can remember when my parents got a new car, they would be sure that the St. Christopher statue was reinstalled in the new vehicle.

Most people at the time thought of St. Christopher as the “patron saint of travel”. This patron of travelers gets his patronage from a thirteenth century legend about a giant man. He lived alone along the bank of a raging river and he would help travelers cross in safety. So it happened one day he helped a small child, who was traveling alone cross. Thus, the universally accepted imagery of the patron saint of travel carrying a small child on his shoulders as he crosses the turbulent river.

Now at this time, it is not certain that this legend ever existed. During those days, many families felt more secure with that plastic statue protecting them. There are all kinds of protection in this world. Sometimes all it takes is a symbol of protection, other times we need more concrete evidence of that protection. Things like a visible police force, locks on our doors, and neighbors and friends that look out for us all help us feel more protected.

In our practices, we need to feel protected sometimes as well. Having a dashboard to look at with our practice can be a great protection of our profitability, our goals, and our overall happiness in practice. Your practice dashboard is a list of key practice indicators that you should track daily to watch trends, make decisions on managing your practice, and plan for the future. So what is on your dashboard? Here are some suggestions for you to start with:

1. Over the Counter Collections

This is the amount of today’s collection you collected from today’s production. It should be expressed as a percentage. Typically, we want this to be 30-35% of today’s production. This shows how well your staff is collecting the patient’s portion of the day’s fees.

2. Overall Collections

Keeping track of today’s total collections is essential to keeping track of where you are at that point in the month. You should have an idea of the average collections you need to meet your goal.

3. Production per Hour for Doctor and Hygienist

Improving production per hour is the one sure way to improve your profitability. Keeping daily tabs on your h

ourly production, as well as, the hygiene hourly production is essential to your success. In a typical practice, an increase of $50 per hour could mean $60,000 in additional profit.

4. Number of New Patients by Source

Tracking the number of new patients each day is important. However, it is even more important to track the source of where those patients come from. This is the only true way to determine how well we do on our internal and external marketing.

5. Future Production Booked for the Next Month

The better the handle you have not only on today’s production, what is on the schedule going forward, the more likely you will take the actions necessary to maintain production goals. By tracking future production, it provides better assurance of consistent future production.

6. Accounts Receivable Balance

Managing your Accounts Receivable is very important to managing your cash flow. Unusual changes in your Accounts Receivable should be investigated immediately.

7. Conversion Ratio

Perhaps one of the greatest lies that dentists tell themselves is the amount or percentage of treatment accepted. The only way to be sure is to track the conversion ratio. In other words, what percentage of the treatment presented today was accepted.

8. Percentage of Hygiene that is Perio

Many practices struggle to get or maintain a strong Perio program. One of the best things you can do is track your daily Perio percentage.

9. Number of Operative Patients Doctor Saw

One of the worst things a dentist can do is schedule too many operative patients in a day. We have found doctors that have more than 8-10 operative patients daily tend to actually lose production. It is essential to be intentional about your schedule.

10. Number of Cancellations or No Shows

Most practices have some problem with cancellations and no shows. It is very helpful to track not only the number, but also if there is a particular hygienist or doctor with higher percentages.

The key to success in practice is “what gets measured gets done”. It may not be as good as a St. Christopher statue, it is the next best thing!

“Science cannot progress without reliable and accurate measurement of what it is you are trying to study. The key is measurement, simple as that.”

Robert D. Hare

by: Ted Schumann, II, MBA, MSF, AIF®, CFP®

When many 401(k) and Profit Sharing plans were first adopted by dental practices, the main focus was on sheltering tax. Owner-Doctors would set up these plans to allow for tax-deductible funding and tax-deferred investing for their employees and themselves. This worked very well historically, and still works very well today to allow Doctors and staff to build sizeable retirement nest eggs. In the old days, it was not uncommon for all participant money to be pooled in the 401(k) or Profit Sharing plan. Furthermore, Doctors would often take it upon themselves, as the plan sponsor, to make investment decisions on behalf of the plan. Some plans even run this way today.

While this arrangement did not give the participants much control over their accounts or transparency in their investments, it did not generally create major problems as long as Doctor, or their advisors, invested the funds prudently and responsibly. It was not until some business owners decided to get “creative” with plan investments that problems arose. Consider the business owner that determined real estate would be a good plan investment, so they used the plan assets to finance the purchase of a cottage.

This kind of activity prompted regulators like the Department of Labor (DOL) to hold plan sponsors more accountable for the investments they made available inside retirement plans. To be most compliant with DOL regulations, the plan must demonstrate a documented process for evaluating and screening investments for inclusion or exclusion from the retirement plan. As you can imagine, an evaluation process is generally not friendly to investments that are opaque. There has been a trend toward increased transparency for this reason.

It is not incumbent upon the plan sponsor to choose the best performing investments. However, it is imperative that a plan sponsor shows criteria for selecting the investments they used. For example, it is a best practice for a 401(k) plan to have a signed Investment Policy Statement. This is a document that outlines how plan assets should be managed, identifies any extenuating circumstances, identifies all plan fiduciaries including the investment committee, and the scope of each party’s authority.

A documented evaluation process and a formal Investment Policy Statement are recommended for trustee directed plans, where the investments are pooled and the plan sponsor makes all the investment decisions. They are also recommended for participant-directed plans, where plan participants choose their own investments according to their own risk tolerance, time horizon, and investment expertise.

Plan fees were also overlooked or ignored in the past. Most rational people understand that no one works for free. Yet it was not until relatively recently that 401(k) and Profit Sharing plan fees got any attention. They are now required to be disclosed. Admittedly, disclosures are not necessarily easy for most plan participants to interpret, but it is a step in the right direction.

For years, plan fees, commissions, and revenue sharing arrangements were buried in mutual fund expense ratios and out-of-pocket costs were low or non-existent. Seldom did the practice owner or employee-participants know who they were paying to do what and how much. Worse than that, most investment professionals were held only to the “Suitability Standard”. This meant that as long as an investment’s risk was not inappropriate for the investor’s situation, it was appropriate and acceptable to sell the client the highest commission product available.

This is a far cry from the way most dentists do business. In my experience, most dentists give their patients treatment options based on the patient’s case and circumstances. Treatment options will vary in cost and feasibility, however, the patient has enough information to make an informed decision about their health. The dentist does not offer only the procedure that will generate the most profit for the practice without giving the patient some other options. Sadly, that is exactly what many financial salespeople were doing to their clients.

Fortunately, the Department of Labor is turning this practice upside down. Readers who know me well know that it is seldom in my nature to welcome even more regulation in the industry. In this case, it makes sense. The Department of Labor is now expanding the requirements of financial professionals that service retirement accounts. All advisors will now be held to the “Fiduciary Standard”, which means they must always act in the client’s best interest; unless, and I wish I was making this up, they qualify for an exemption known as the Best Interest Contract Exemption (BICE). Yes, a loophole exists to actually exempt an advisor from acting in the client’s best interest.

The new Fiduciary Standard is nothing new to Registered Investment Advisory firms like DBS Investment Advisers, LLC. We have always been held to the Fiduciary Standard. So for firms like ours, it is business as usual. For the more commission-oriented Broker Dealer-type firms, this is a major paradigm shift. Some of these firms have decided to discontinue managing some types of retirement accounts altogether. For example, Edward Jones has made significant changes to their business model due to the new requirements.

Retirement plan sponsors also have a fiduciary responsibility and liability for monitoring plan fees. Recently, some plan sponsors have been sued by plan participants (employees) because of excessive plan fees. Excessive fees are a result of the plan sponsors breached duty to monitor and benchmark plan fees. This includes mutual fund expense ratios, revenue sharing paid by plan investments, advisory fees, and fees charged by record-keepers (investment companies), and plan administrators.

As you can see, management and maintenance of retirement plans has evolved over time. While dentists were once able to make deposits into their plans, take applicable tax deductions, and invest the money as they wished with little regard to fees or investment process, those days are gone. The bar is now higher and decisions at a plan level must be made more thoughtfully. In addition to portfolio management, support of the fiduciary process is a big part of what we do for our clients. If you have not thoroughly reviewed your retirement plan lately, you need to. If you have never reviewed your retirement plan, I can help. Feel free to contact me at ted.schumann@dbsia.net to schedule a no-obligation fiduciary review.

by: Daniel Peters, DDS

Try not to smile when you think of the exact patient family in your practice that I am talking about. Mr. and Mrs. Tightwad come into your office for their “cleaning” appointments in mid- December. The hygienists check the charts and realize that they have not been seen in eight months despite their history of perio treatment and the fact that both the hygienists and doctor recommended three month recalls. Mrs. Tightwad presents with progressing perio and her usual downright nasty attitude. Mr. Tightwad presents with progressing perio and a failing ancient, huge amalgam on tooth #3. The hygienist works her tail off on Mrs. Tightwad, re- educates on perio disease for the 15th time, and urges a three month follow up appointment. The other hygienist works her tail off on Mr. Tightwad, re-educates on perio disease for the 15th time, urges a three month recall, makes the patient aware of the failing huge amalgam on tooth #3, uses the intraoral camera to display this condition to the patient, and does a fantastic job of educating him on the need for a crown on this tooth. The doctor comes into the room and does her exam on Mrs. Tightwad. She backs the hygienist up on the importance of maintaining the perio condition and does her best to educate Mrs. Tightwad some more as Mrs. Tightwad gets a nasty look on her face and rolls her eyes. The doctor then goes to the room next door to do her exam on Mr. Tightwad. Mr. Tightwad is alarmed by his perio condition and really does not want to lose tooth #3. He listens to the hygienist and doctor, agrees to a three month recall, and seems ready to schedule the crown on #3.

This couple then goes to the front desk to meet the scheduling coordinator. The scheduling coordinator first offers both patients a three month recall appointment. Mrs. Tightwad snaps that when you are on a fixed income, you are not able to spend that kind of money. The scheduling coordinator then goes on to re-educate yet again on the importance of maintaining perio. Mrs. Tightwad reluctantly agrees to four month recalls for her and Mr. Tightwad which will occur right after they return from their winter home in Florida. The scheduling coordinator then offers a core and crown appointment for Mr. Tightwad. Mrs. Tightwad immediately chimes in that they will talk about that at their next appointment. The scheduling coordinator again slips into education mode and does a great job making the point that if Mr. Tightwad wants to keep his tooth, a crown is essential. She even offers to rush the process along so the crown can be cemented before the couple leaves for Florida on January 2nd. Mrs. Tightwad again refuses and the scheduling coordinator feels sorry for Mr. Tightwad who has been staring at the floor during this entire interaction.

Mr. and Mrs. Tightwad head out the door into their new Cadillac which still has the sticker in the back window. This car has just replaced their two year old Cadillac. They do need a safe car to drive to their winter home in the Sunshine State after all! March rolls along and the Tightwads arrive home from Florida to find a postcard in their mailbox reminding them of their appointments in a couple weeks. Mrs. Tightwad calls the office and insists on moving their appointments back to July because when you are on a fixed income you are not able to spend that kind of money.

Mr. and Mrs. Tightwad come into your office for their “cleaning” appointments in July. The hygienists check the charts and realize that they have not been in for eight months despite their history of perio treatment and the fact that both the hygienists and doctor recommended three month recalls. Mrs. Tightwad presents with progressing perio and her usual downright nasty attitude. Mr. Tightwad presents with progressing perio and a massive hole adjacent to tooth #3. The hygienist works her tail off on Mrs. Tightwad, re-educates on perio disease for the 16th time, and urges a three month follow up appointment. The other hygienist works her tail off on Mr. Tightwad, re-educates on perio disease for the 16th time, urges a three month recall, makes the patient aware of the massive hole, uses the intraoral camera to display this condition to the patient, and does a fantastic job of educating him that this tooth is in serious trouble and that they will have to ask the doctor if she can save it. The doctor comes into the room and does her exam on Mrs. Tightwad. She backs the hygienist up on the importance of maintaining the perio condition and does her best to educate Mrs. Tightwad some more as Mrs. Tightwad gets a nasty look on her face and rolls her eyes. The doctor then goes to the room next door to do her exam on Mr. Tightwad. Mr. Tightwad is alarmed by his perio condition and really does not want to lose tooth #3. He listens to the hygienist and doctor, agrees to a three month recall, and is very disappointed when the doctor recommends extraction of tooth #3.

This couple then goes to the front desk to meet the scheduling coordinator. The scheduling coordinator first offers both patients a three month recall appointment. Mrs. Tightwad snaps that when you are on a fixed income you are not able to spend that kind of money. She then expresses dismay that the doctor cannot pull Mr. Tightwad’s tooth that same day. Mr. Tightwad stares at the floor.

Smiling yet because this couple are patients of yours? Perhaps dismayed, crying, or getting depressed instead? As I wrote the story above I had a mental image of the real Mr. and Mrs. Tightwad that I used to see in our practice. We all have them and they drive us all nuts. Is it any wonder that dentists get unsatisfied, depressed, and burned out?

The true issue in the vast majority of cases, when treatment that we and our teams recommend is rejected, has nothing to do with the patient’s ability to pay for the recommended treatment. It has everything to do with the perceived value of the recommended treatment. Truth be told, dentists compete very little with each other in the marketplace. Our true competition is companies like Starbucks, Apple, Amazon, and BMW as well as airlines, vacation destinations, and spas.

Next month I’ll cover how we go about building value to compete with our true competitors.

Side Note: The ADA just reported that in 2015 the average income for GP dentists was $179,960. For Specialists, the average income was $320,460 for the same period. For owner GP’s, the average income was $195,200. For non- owner GP’s, income was $132,370. When adjusted for inflation, GP income has dropped significantly since the peak in 2005 when earnings had a value of $219,638 when adjusted to 2015 dollars. This bothers the heck out of me. If you are experiencing this same alarming trend in your own situation, please give me a call and let’s talk about it.

by: Rachelle Fenwick, Asst. Accounting Manager

Most businesses have unclaimed property resulting from normal operations. Any asset, tangible or intangible, belonging to a third party that remains unclaimed for a specified period of time is considered unclaimed property. For example, uncashed payroll checks must be turned over to the State after one year. Most other property types, such as vendor checks and accounts receivable credit balances, must be turned over after three years. Government entities must turn over all unclaimed property, regardless of property type, after one year.

Michigan’s Uniform Unclaimed Property Act, Public Act 29 of 1995, as amended, requires businesses and government entities to report and remit to the Michigan Department of Treasury abandoned and unclaimed property belonging to owners whose last known address is in Michigan. In addition, every business or government entity that is incorporated in Michigan must report and remit abandoned property belonging to owners where there is no known address.

An outstanding payroll or commission check has a one year dormancy period. A refund due to a patient or a credit on your accounts receivable has a three year dormancy period. For a complete list of property dormancy periods, see the dormancy chart in Appendix A of the Treasury website. That website is www.michigan.gov/unclaimedproperty.

The due date this year for filing the unclaimed property annual report is July 1, 2017, for property reaching its dormancy period as of March 31, 2017. The recommended timeline for Unclaimed Property Review is as follows:

March 31

Identify properties that could be reportable as unclaimed property as of March 31

April 15

**Prepare and mail due diligence letters to those property owners identified as inactive.

May 15

Determine property owners with whom contact has not occurred (i.e., returned mail, no response, etc.)

June 1

Begin preparing the annual unclaimed property report using reporting software. A free version of the software may be downloaded at the website listed above located in the Reporting Unclaimed Property section.

On or Before July 1: Mail the electronic media containing the annual unclaimed property report, Michigan Holder Transmittal for Annual Report of Unclaimed Property (Form 2011) and remittance to the Unclaimed Property Division. If your entity has no unclaimed property to report, you do not need to file anything.

**Michigan law requires holders to send written notice to owners at their last known address informing them that they hold property subject to being turned over to the State. This requirement only applies if all of the following conditions exist:

- The address for the owner does not appear to be inaccurate

- The property has a value of $50 or more

- The statute of limitation does not bar the claim of the owner

Notice must be sent not less than 60 days, nor more than 365 days, before the filing of the report. See the Appendix for samples of due diligence letters.

Complete instructions and forms are available in the Manual for Reporting Unclaimed Property.

The amount of properties that a holder reports determines the method for reporting.

Those reporting 10 or more properties – File using free third-party software Those reporting less than 10 properties – File using free third-party software or paper forms.

Holders who have previously filed unclaimed property reports with the State of Michigan now have the ability to remit payment for their unclaimed property report. Since this payment method requires validation, this payment method is not available to first time filers.

Treasury is providing entities that have not previously reported or have underreported unclaimed property in the past with an opportunity to voluntarily comply with the requirements of the Michigan Unclaimed Property Act (Act) by offering a Voluntary Disclosure Agreement.

Entities that submit a Voluntary Disclosure Agreement indicate their desire to be compliant with the Act. Accordingly, the holder agrees to voluntarily comply with the Act by reporting and remitting previously unreported unclaimed property due the State of Michigan. In accordance with the Voluntary Disclosure Agreement, the holder agrees to accurately complete and file unclaimed property reports and remit payments for the current reporting year and the previous four reporting years within six months from the date the form is filed with the Unclaimed Property Division. Holders will not be assessed penalties or interest.

If a property holder fails to properly file a report, penalty and interest may be assessed as follows:

- Interest at one percentage point above the adjusted prime rate per annum per month on the property or value of the property from the date the property should have been paid or delivered, and /or

- Penalty at 25 percent of the value of the property that should have been paid or delivered.

The information for this article can be found online at www.michigan.govunclaimedproperty located in the Reporting Unclaimed Property section. If you have any questions, please call your accountant for further details.

What’s NEW?

Senate Bill 538 amends the Uniform Unclaimed Property Act of 1995 effective 12/22/15. Properties with a value of $25.00 or less are not required to be escheated per Section 567.224a Sec 4a.

- Does not apply to dividends or stock- related properties defined in Section 567.231a Sec. 11a.

- These properties can still be voluntarily escheated.

New streamlined audit option described in Section 567.25 1b Sec. 31b for businesses whose principal place of business is in Michigan as defined by Section 567.222 Sec. 2. This is retroactive and applies to audits in progress as of August 15, 2015, but does not retroactively apply to contested determinations in litigation before the date of enactment of this amendatory act.

by: Joyce Olson-Burpee, Computer Operations Manager

What do you think of a company not taking a security exploit serious? I think it is criminal. With all the ways the hackers and crooks can get into our computers anyway, it is terrible that a company as big as Microsoft does not patch a security issue even after they had been told of it three months earlier.

The security hole has now been released into what is known as the wild so anyone can exploit the problem if they know how. That falls into many people’s realm of knowledge. There should be a huge fine for companies that are told about security flaws and do not fix them. They should be held accountable for any damage that it causes their users.

I know many people have no idea how to fix these things themselves. It is in your own best interest to have a friend or a company that knows what is going on in the world of technology help you review things out there that can harm your system.

It is important to have your information protected, especially if your computer systems harbor confidential information such as customer’s names, addresses, and social security numbers. These are the things people use to steal identities.

Please be sure your company is taking care of the important things on your computer and have a qualified person or company taking care of the necessary security. A qualified person will be able to block the security flaw that was announced and not patched by Microsoft (SMB2 TREE- CONNECT…). They will most likely patch this on their next update. In the meantime, computers can fall prey to this flaw.

If you have a connection to the internet and you have not hired a security person or company, it would be in your best interest to do so.

Happy computing!

by: Sarah Pajot, Transition Specialist

Are you thinking about bringing an Associate into your practice? If so, there are some questions that you need to ask yourself. Why now? What will an Associate do for you or your practice? Do you want an Associate because you are swamped, or you like the idea of more free time, or because it worked for your colleagues? In a different direction, is the concept of hiring an Associate to permit you to cut back, and having an Associate could replace those hours and keep your practice vital prior to an eventual sale? Ask yourself if you are ready to take less income home. If the need is not real, then you are only building in more overhead, reducing your profit, and perhaps destabilizing your practice. If your plan is to keep your practice vital and still allow you to cut back, then there are some ground rules to hiring an Associate:

- Do you have enough active patients in your practice to give the Associate enough hours to make it worth their while to come work for you? At the very least, you would need 2,000 active patients to hire an Associate.

- Are you thinking that this Associate is your built-in buyer for your practice, a possible partner, or do you want to remain in control and just need help in your practice?

You need to determine if the practice can accommodate an Associate. In addition to the active patient count, do you have enough treatment rooms for both you and the Associate to work the same hours? If not, you may need to increase the office hours to do a staggered schedule; so you can both work efficiently. Do you have enough staff to accommodate two dentists and to increase office hours or will you need to add another assistant to accommodate the new Associate? Is there any treatment that you currently refer out that an Associate could perform thereby creating a new profit center in the practice? Is there any specific treatment that you refer out that you would prefer that the Associate not do in the practice?

For example, if the Associate starts an ortho case and then leaves, how do you determine how this case will be completed if you do not do ortho?

A new factor we need to look at now is insurance in your office. Are you a Delta Premier provider? This could be an issue. Most new dentists applying for an Associate position are not Premier providers. How would you handle this in your office? Will the insurance company reimburse you with a different fee schedule depending on the provider?

How will you determine what treatment the Associate will provide if their fees are lower than yours? Who will see the new patients in the practice?

How will you determine if you and the Associate can work together in harmony? Are your practice philosophies the same? Consider doing a personality profile to ensure a good match. What are the Associate’s expectations for working in your practice? Have a frank discussion about your expectations and the parameters the Associate would work under. What are the personal and professional goals of the Associate? What are your goals concerning the Associate?

When you interview potential Associates, you can give them an idea of what you expect and what they can expect. Although you can be somewhat flexible with the Associate, it is good to know the following:

- Will the Associate be an Independent Contractor or an Employee?

- How will they be compensated: percentage of production or collections?

- Who pays for lab fees? and at what percentage?

- What benefits will you provide: health insurance, retirement plan, vacation, holidays, continuing education allowance, malpractice insurance, etc.?

- Will you pay for dues, licenses, etc?

- What administrative tasks will be their responsibility?

- Will they have any management or marketing duties?

- Will they be a part of the practice decision making process?

- Will they be required to attend staff meetings?

There is a long list of items to be determined to have a successful Associate Agreement. These are just a few of the items you will need to concern yourself with.

Whatever the reason to have an Associate, you will want to plan ahead before you bring the dentist into your office; make sure you have all the appropriate contracts in place to protect both you and the Associate. You would need to have an Associate contract that spells out all your expectations of the Associate’s employment, and a Covenant not to Compete; should they decide to leave your employment. The Covenant not to Compete can be signed with a 90-day clause; that way if either of you decide before 90 days is passed that it is not working, the Associate moves on and there is no Covenant. Or it is working and the Covenant goes into effect as of the 91st day. There is no harm to anyone that way. An Associate cannot hurt your practice in 90 days. Please have your attorney draft these documents to make sure they are legally binding and protect you.

The best suggestion I can make is to have advisors, who know your individual practice, help you determine if you are ready for an Associate in your practice. They will help you determine if your practice is large enough for an Associate, if you are ready for an Associate, or if you can work with an Associate. They will help you plan to attract the Associate that would work best in your practice. If you are thinking about an Associate, call your DBS advisors today. We welcome your questions regarding Associates.

[ajax_load_more container_type="div" post_type="post" posts_per_page="10" button_label="Older Articles" button_loading_label="Loading Articles..."]