So far, stocks have been struggling in 2022; they fell especially hard in April and the trend appears to be continuing into May. While it’s human nature to be initially unsettled by market turbulence, this recent market volatility is not a reason to panic or sell all your positions. If you are a day trader, you would have good reason to panic, but we are long-term investors, not traders.

Investors must remember that markets tend to be irrational in the short term, and certainly don’t need reasons for behaving (or misbehaving) the way they do. However, recent market conditions can be at least somewhat attributed to the following:

- Interest rates are moving higher, which can be bad for stocks and especially bad for high growth stocks.

- Increasing interest rates prompt growth stock investors (tech stocks tend to be growth stocks) to revaluate what they are willing to pay for the stocks based on discounted earnings. The higher rates go, the less valuable tech stocks look.

- Inflation is causing the prices of everything to increase. This also hurts corporate earnings. When it costs more for companies to make their products, they either charge more for their product or have less profit. Usually, it is a combination of both.

- However, not all parts of the market abhor inflation. It should be noted that commodities are doing especially well in the current market and inflationary environment.

- COVID-19 is still present around the world. Even though life here in the U.S. resembles pre-pandemic “normal”, the rest of the world isn’t there yet. For example, China has lockdowns in place that are causing factories to close and products to be delayed. This will have an effect on our store shelves for many months to come; most likely extending supply chain pains and contributing to transitory inflation.

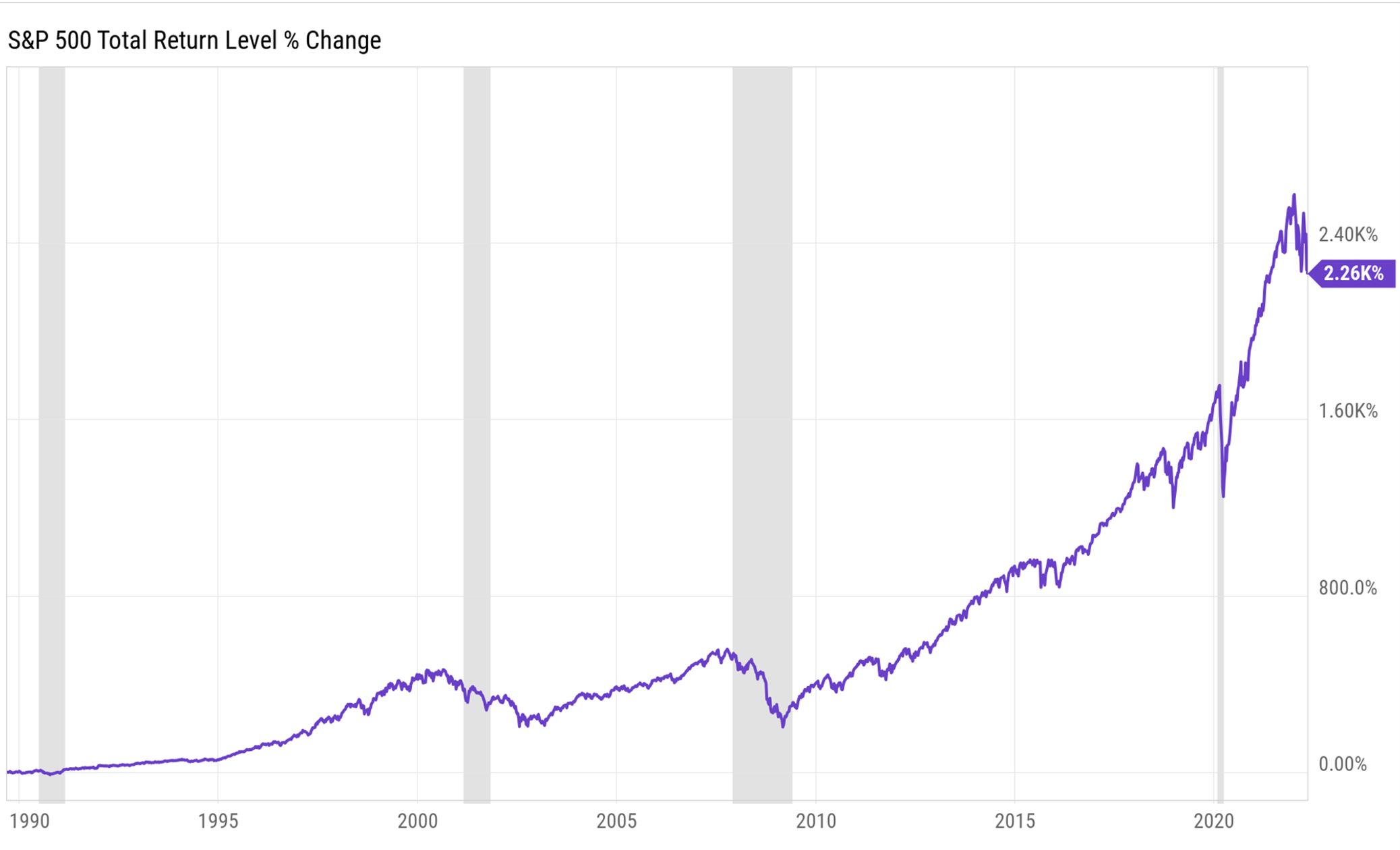

Volatility is expected to be with us through the summer and possibly much longer. We had experienced a prolonged, calm, upward movement in the stock market for the past two years (as shown in the graph), brought on by the measures to combat the COVID-19 pandemic. The Federal Reserve just raised interest rates for the second time this year—as they had previously indicated they would do—and we expect they will continue to raise rates throughout the rest of the year. In response to the Fed raising rates, the stock market in turn fell more than 5% the day of this writing (5/5/2022). This can be great news for those of us with cash in the bank wanting to earn interest and for investors to lock in a higher bond yield than we have seen in the past 3 years.

Investors still in the accumulation phase—those working and making regular deposits (known as dollar-cost-averaging)—should not be disturbed by current market conditions. They are in a great position to take advantage of temporary market weakness and buy investments during market lows. As Warren Buffett once said, “The best chance to deploy capital is when things are going down.”

Investors in the distribution phase, like retirees, should be taking withdrawals from the cash positions of their portfolio so as not to sell during times of market turbulence.

This is a perfect time to remember to invest for the long-term and rebalance your portfolio on regular intervals. It is not a time to sell your portfolio and go into cash. Instead, it is a good time to add to strategies that do well with inflation and rising interest rates, such as commodities, small cap stocks, and consumer staples. If you would like to discuss your current investment allocation or how current market conditions are affecting your portfolio, please feel free to contact me at ted.schumann@dbsia.net or 800-327-2377.